Recursion Provides Business Updates and Reports Third Quarter 2024 Financial Results

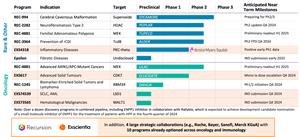

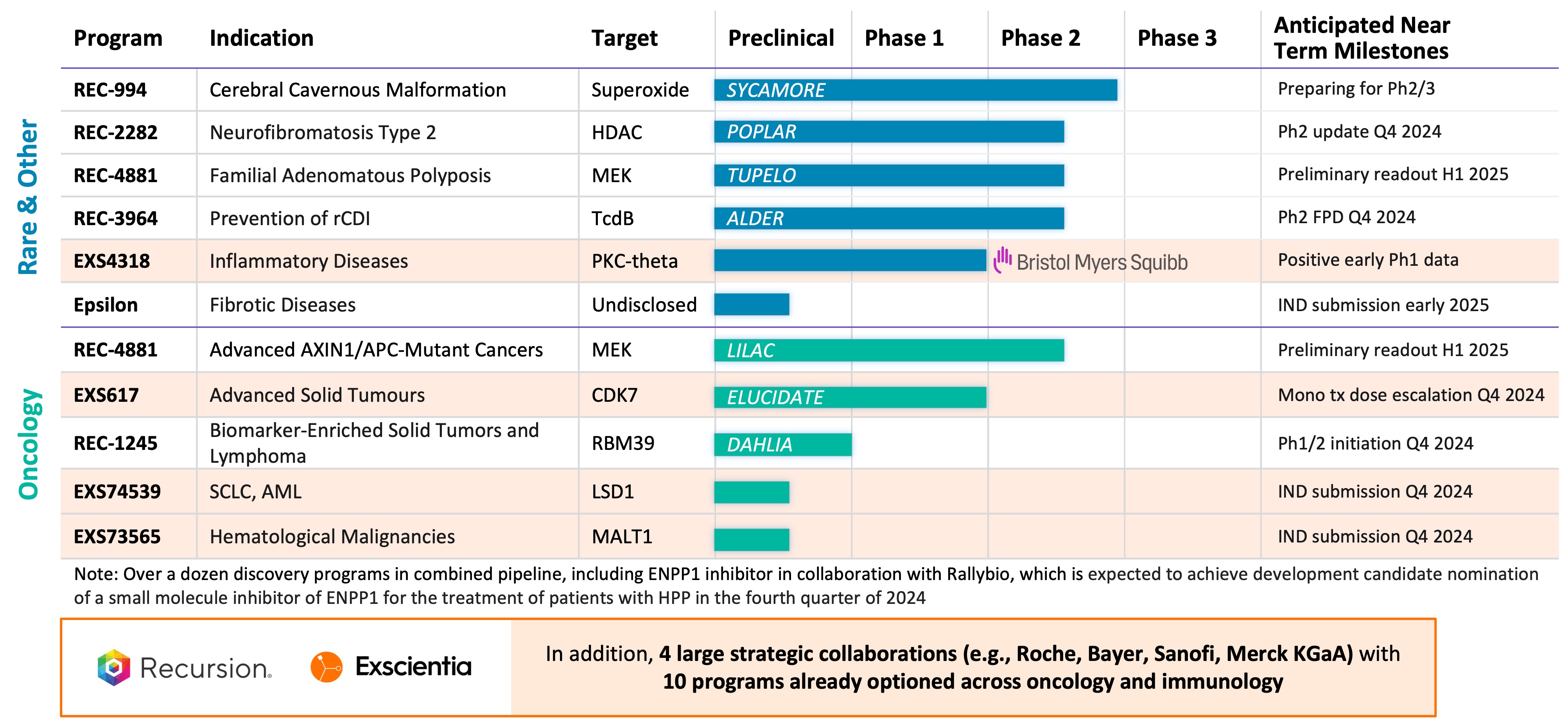

- Multiple clinical trial milestones were achieved, including encouraging topline data for a Phase 2 trial in CCM, the first patient dosed for a Phase 2 trial in recurrent C. difficile infection, and IND clearance for a Phase 1/2 trial in biomarker-enriched solid tumors and lymphoma (Target RBM39), which highlight a growing number of potential clinical program catalysts

- Our first neuroscience phenomap was optioned by Roche-Genentech for

$30 million as part of a fee structure that could exceed a total of$500 million across multiple maps before program-specific milestones or royalties - Entered into an expanded collaboration with

Google Cloud to leverage technologies to support our drug discovery platform, which continues to highlight Recursion’s close partnership with leading technology companies likeGoogle , NVIDIA, Tempus, and others - The potential business combination with

Exscientia continues to advance towards close with a special shareholder meeting to be held onNovember 12, 2024 and an expected date for the scheme of arrangement to beNovember 20, 2024

“We are excited to continue to drive rapidly towards the closure of our proposed business combination with

Summary of Business Highlights

- Pipeline

- Cerebral Cavernous Malformation (CCM) (REC-994): In September, we announced that our Phase 2 SYCAMORE clinical trial, which is a randomized, double-blind, placebo-controlled, study of two doses of REC-994 in participants with CCM, met its primary endpoint of safety and demonstrated encouraging trends in objective MRI-based exploratory efficacy measures at the highest dose, seeing reductions in lesion volume and hemosiderin ring size. We plan to meet with the FDA and advance the development of REC-994 for the potential treatment of symptomatic CCM in subsequent studies. We also plan to present the Phase 2 data at a medical conference and publish results in a peer reviewed scientific journal.

- Neurofibromatosis Type 2 (NF2) (REC-2282): Our adaptive Phase 2/3 POPLAR clinical trial is an open label, two part study of REC-2282 in participants with progressive NF2-mutated meningiomas. Part 1 of the study explores two doses of REC-2282 in adult and pediatric participants. Enrollment of adult patients in Part 1 of the study is complete (n=24). We expect to share an update in Q4 2024.

- Familial Adenomatous Polyposis (FAP) (REC-4881): Our Phase 1b/2 TUPELO clinical trial is an open label, multicenter, two part study of REC-4881 in participants with FAP. Part 1 is complete and enrollment in Part 2 has commenced. We expect to share Phase 2 safety and preliminary efficacy data in H1 2025.

- APC or AXIN1 Mutant Cancers (REC-4881): Our Phase 2 LILAC clinical trial is an open label, multicenter study of REC-4881 in participants with unresectable, locally advanced or metastatic cancer with AXIN1 or APC mutations. We expect to share Phase 2 safety and preliminary efficacy data in H1 2025.

- Clostridioides difficile Infection (REC-3964): In October, we announced the first patient dosed in our Phase 2 clinical study of REC-3964, a potential first-in-class, oral, non-antibiotic small molecule for recurrent Clostridioides difficile infection. Our Phase 2 ALDER clinical trial is an open-label, multicenter randomized study designed to evaluate rates of recurrence with REC-3964 at two doses compared with an observational cohort after patients have achieved initial cure with vancomycin. We expect a preliminary readout by the end of 2025.

- Biomarker-Enriched Solid Tumors and Lymphoma, Target RBM39 (REC-1245): In October, we announced FDA clearance of an IND for REC-1245, a potential first-in-class RBM39 degrader for biomarker-enriched solid tumors and lymphoma. RBM39 is a novel CDK12-adjacent target identified by the Recursion OS. We plan to initiate dosing of Phase 1/2 in Q4 2024 to evaluate REC-1245. Phase 1 data from the dose-escalation portion of the study is expected by the end of 2025.

- Undisclosed Indication in Fibrosis, Target Epsilon: We are advancing our lead candidate and expect an IND submission in early 2025.

- Partnerships

- Transformational Collaborations: We continue to advance efforts to discover potential new therapeutics with our strategic partners in the areas of undruggable oncology (Bayer) as well as neuroscience and a single indication in gastrointestinal oncology (Roche-Genentech). In August, our first neuroscience phenomap was optioned by Roche-Genentech for

$30 million as part of a fee structure that could exceed a total of$500 million across multiple maps. In the near-term, there is the potential for option exercises associated with partnership programs and map building initiatives or data sharing.

- Transformational Collaborations: We continue to advance efforts to discover potential new therapeutics with our strategic partners in the areas of undruggable oncology (Bayer) as well as neuroscience and a single indication in gastrointestinal oncology (Roche-Genentech). In August, our first neuroscience phenomap was optioned by Roche-Genentech for

- Platform

Google Cloud Collaboration: We entered into an expanded collaboration withGoogle Cloud in order to leverageGoogle Cloud's technologies to support our drug discovery platform. This strategic partnership includes exploring generative AI capabilities, including Gemini models, to support the RecursionOS, drive improved search and access with BigQuery, and help scale compute resources. In addition, we will also explore making some of our AI models available onGoogle Cloud.

Additional Corporate Updates

- Combination with

Exscientia : A special shareholder meeting will be held onNov 12, 2024 at5:00 pm Eastern Time /3:00 pm Mountain Time in order to vote on Recursion’s proposed combination withExscientia . Shareholders may vote in advance of this meeting by telephone, mail, or online at www.virtualshareholdermeeting.com/RXRX2024SM. Following this shareholder meeting, we expect the date of the scheme of arrangement to beNov 20, 2024 . - L(earnings) Call: We will not host a L(earnings) Call in relation to the business updates and financials for the third quarter. Instead, we expect to host an Update Call around the date of the scheme of arrangement which is expected to be

Nov 20, 2024 . We will broadcast the live stream from Recursion’s X (formerly Twitter), LinkedIn, and YouTube accounts and there will be opportunities to ask questions of the company. Chief People & Impact Officer: In October,Erica Fox joined Recursion as itsChief People & Impact Officer.Ms. Fox has over 20 years experience as a people and systems strategist having previously led various human resource functions at technology companies Primer.ai andGoogle .

Third Quarter 2024 Financial Results

- Cash Position: Cash and cash equivalents were

$427.6 million as ofSeptember 30, 2024 . - Revenue: Total revenue was

$26.1 million for the third quarter of 2024, compared to$10.5 million for the third quarter of 2023. The increase was due to revenue recognized from our partnership with Roche &Genentech and the$30.0 million acceptance fee for the completion of a neuroscience phenomap. - Research and Development Expenses: Research and development expenses were

$74.6 million for the third quarter of 2024, compared to$70.0 million for the third quarter of 2023. The increase in research and development expenses was driven by our platform and personnel costs as we continue to expand and upgrade our platform, including our chemical technology, machine learning, and transcriptomics platform. - General and Administrative Expenses: General and administrative expenses were

$37.8 million for the third quarter of 2024, compared to$29.2 million for the third quarter of 2023. The increase in general and administrative expenses compared to prior period was primarily driven by an increase in software and lease expense. - Net Loss: Net loss was

$95.8 million for the third quarter of 2024, compared to a net loss of$93.0 million for the third quarter of 2023. Net Cash : Net cash used in operating activities was$59.2 million for the third quarter of 2024, compared to$72.9 million for the third quarter of 2023. The change in net cash used in operating activities compared to the same period last year was the net result of the$30.0 million acceptance fee received during the third quarter of 2024, partially offset by the higher operating costs incurred for research and development and general and administrative activities.

About Recursion

Recursion is a clinical stage TechBio company leading the space by decoding biology to industrialize drug discovery. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously expands one of the world’s largest proprietary biological, chemical and patient-centric datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale — up to millions of wet lab experiments weekly — and massive computational scale — owning and operating one of the most powerful supercomputers in the world, Recursion is uniting technology, biology, chemistry and patient-centric data to advance the future of medicine.

Recursion is headquartered in

Media Contact

Media@Recursion.com

Investor Contact

Investor@Recursion.com

| Condensed Consolidated Statements of Operations and Comprehensive Loss (unaudited) |

||||||||||||||

| (in thousands, except share and per share amounts) |

||||||||||||||

| Three months ended | Nine months ended | |||||||||||||

| Revenue | 2024 | 2023 | 2024 | 2023 | ||||||||||

| Operating revenue | $ | 26,082 | $ | 10,102 | $ | 53,977 | $ | 33,252 | ||||||

| Grant revenue | - | 431 | 316 | 432 | ||||||||||

| Total revenue | 26,082 | 10,533 | 54,293 | 33,684 | ||||||||||

| Operating costs and expenses | ||||||||||||||

| Cost of revenue | 12,079 | 10,877 | 32,444 | 32,706 | ||||||||||

| Research and development | 74,600 | 70,007 | 216,087 | 171,744 | ||||||||||

| General and administrative | 37,757 | 29,199 | 100,998 | 80,364 | ||||||||||

| Total operating costs and expenses | 124,436 | 110,083 | 349,529 | 284,814 | ||||||||||

| Loss from operations | (98,354 | ) | (99,550 | ) | (295,236 | ) | (251,130 | ) | ||||||

| Other income, net | 2,679 | 6,533 | 9,347 | 16,060 | ||||||||||

| Loss before income tax benefit | (95,675 | ) | (93,017 | ) | (285,889 | ) | (235,070 | ) | ||||||

| Income tax benefit | (167 | ) | - | 1,134 | - | |||||||||

| Net loss and comprehensive loss | $ | (95,842 | ) | $ | (93,017 | ) | $ | (284,755 | ) | $ | (235,070 | ) | ||

| Per share data | ||||||||||||||

| Net loss per share of Class A, B and Exchangeable common stock, basic and diluted | $ | (0.34 | ) | $ | (0.43 | ) | $ | (1.12 | ) | $ | (1.16 | ) | ||

| Weighted-average shares (Class A, B and Exchangeable) outstanding, basic and diluted | 282,583,048 | 214,327,186 | 253,447,099 | 203,090,637 | ||||||||||

| Condensed Consolidated Balance Sheets (unaudited) |

|||||||

| (in thousands) |

|||||||

| 2024 | 2023 | ||||||

| Assets | |||||||

| Current assets | |||||||

| Cash and cash equivalents | $ | 427,647 | $ | 391,565 | |||

| Restricted cash | 1,555 | 3,231 | |||||

| Other receivables | 2,255 | 3,094 | |||||

| Other current assets | 42,715 | 40,247 | |||||

| Total current assets | 474,172 | 438,137 | |||||

| Restricted cash, non-current | 6,629 | 6,629 | |||||

| Property and equipment, net | 84,410 | 86,510 | |||||

| Operating lease right-of-use assets | 47,882 | 33,663 | |||||

| Financing lease right-of-use assets | 26,897 | - | |||||

| Intangible assets, net | 34,093 | 36,443 | |||||

| 52,056 | 52,056 | ||||||

| Other assets, non-current | 360 | 261 | |||||

| Total assets | $ | 726,499 | $ | 653,699 | |||

| Liabilities and stockholders’ equity | |||||||

| Current liabilities | |||||||

| Accounts payable | $ | 2,260 | $ | 3,953 | |||

| Accrued expenses and other liabilities | 40,597 | 46,635 | |||||

| Unearned revenue | 49,579 | 36,426 | |||||

| Operating lease liabilities | 8,233 | 6,116 | |||||

| Notes payable and financing lease liabilities | 8,219 | 41 | |||||

| Total current liabilities | 108,888 | 93,171 | |||||

| Unearned revenue, non-current | 15,712 | 51,238 | |||||

| Operating lease liabilities, non-current | 53,663 | 43,414 | |||||

| Notes payable and financing lease liabilities, non-current | 20,510 | 1,101 | |||||

| Deferred tax liabilities | 168 | 1,339 | |||||

| Other liabilities, non-current | 2,999 | - | |||||

| Total liabilities | 201,940 | 190,263 | |||||

| Commitments and contingencies | |||||||

| Stockholders’ equity | |||||||

| Common stock (Class A, B and Exchangeable) | 3 | 2 | |||||

| Additional paid-in capital | 1,776,933 | 1,431,056 | |||||

| Accumulated deficit | (1,252,377 | ) | (967,622 | ) | |||

| Total stockholder's equity | 524,559 | 463,436 | |||||

| Total liabilities and stockholders’ equity | $ | 726,499 | $ | 653,699 | |||

Forward-Looking Statements

This document contains information that includes or is based upon "forward-looking statements'' within the meaning of the Securities Litigation Reform Act of 1995, including, without limitation, those regarding expectations related to early and late stage discovery, preclinical, and clinical programs, including timelines for enrollment in studies, data readouts, and progression toward IND-enabling studies; the timing and likelihood of completing the proposed business transaction with

Additional Information and Where to Find It

This communication relates to the proposed business combination by and between

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT (WHICH INCLUDES AN EXPLANATORY STATEMENT IN RESPECT OF THE SCHEME OF ARRANGEMENT OF EXSCIENTIA, IN ACCORDANCE WITH THE REQUIREMENTS OF THE

Participants in the Solicitation

The Company,

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The Company securities issued in the proposed business combination are anticipated to be issued in reliance upon an available exemption from such registration requirements pursuant to Section 3(a)(10) of the Securities Act of 1933, as amended.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3213e888-501b-4736-adad-9672e8e8792a

Source: Recursion Pharmaceuticals