Recursion Provides Business Updates and Reports First Quarter 2023 Financial Results

- Entered into agreements to acquire Cyclica and

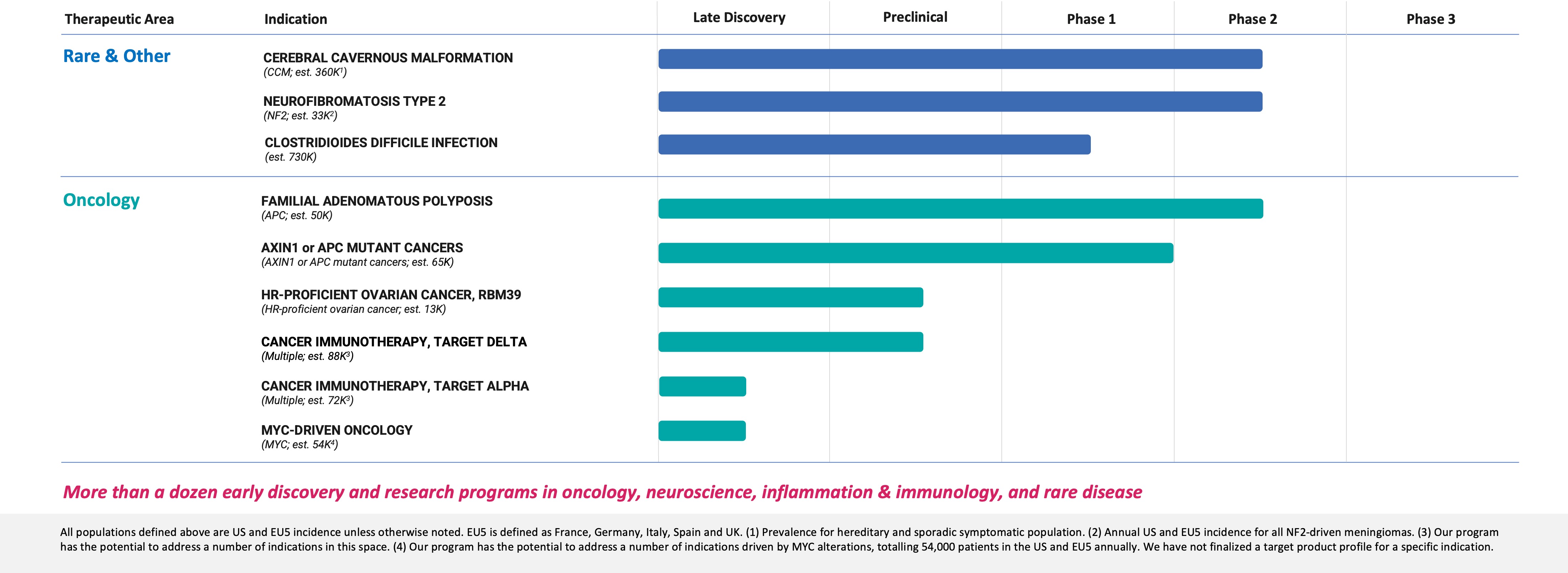

Valence to bolster digital chemistry and generative AI capabilities in order to further create new chemical composition of matter for novel biological targets - Advanced 4 active clinical trials, including an exploratory Phase 2 study of REC-994 in Cerebral Cavernous Malformation where more than 80% of planned participants have enrolled

- Phase 2 trial in AXIN1 or APC mutant solid tumors remains on track to initiate in early 2024

- Advanced our RBM39 HR-proficient ovarian cancer program (previously identified as Target Gamma) to the preclinical stage and have initiated IND-enabling studies

“Recursion has pioneered the massive, parallel generation of -omics data with machine learning in order to map and navigate biology to discover new medicines faster. The strategic acquisitions of Cyclica and

Summary of Business Highlights

- Digital Chemistry and Generative AI Acquisitions

- Cyclica: Cyclica has built an industry-leading digital chemistry software suite which enables mechanism of action deconvolution, generative chemistry, and molecular optimization tools. Recursion completed a prospective, blinded evaluation of their software against challenging internal programs, where we gained deep confidence in the power of their tools and reinforced our belief that this team could accelerate Recursion’s work across its pipeline and partnerships by rapidly advancing the discovery of new chemical entities. We believe that Cyclica’s tools will enhance the optimization of our compounds for efficacy while minimizing liabilities through generative machine learning approaches. The company is located in

Toronto , where Recursion maintains its biggest hub outside of its headquarters, and the teams at Cyclica will be fully integrated into Recursion. Valence :Valence is a ML/AI-native digital chemistry company which has pioneered the development of novel hybrid graph neural networks and transformers for state-of-the-art chemical property prediction. The small team atValence has led a massive open-science movement with a network of academic collaborators at the pinnacle of machine learning, chemistry and other fields. Based inMontréal , where Recursion also maintains a ML research team,Valence will work on cutting-edge applied ML research across chemistry and biology. We believe that the technology they have built and will build will enable acceleration of our work at Recursion across many fields, beginning with generative design of new molecules, DMPK predictions, and more. Combined with Recursion’s wet-lab data generation capabilities and one of the largest relatable datasets in the industry, the team will also accelerate ongoing internal work to build foundation models, large-language models and other approaches leveraging active learning.- Financial Impact of Acquisitions: Recursion has entered into agreements to acquire Cyclica for a purchase price of

$40 million andValence for a purchase price of$47.5 million , in each case subject to customary closing and post-closing purchase price adjustments. The purchase price in the acquisitions will be payable in the form of shares of Recursion Class A common stock, shares of a subsidiary of Recursion exchangeable for shares of Recursion’s Class A common stock and the assumption of certain outstandingValence and Cyclica options. In certain circumstances, Recursion may pay cash consideration toValence and Cyclica shareholders in lieu of such exchangeable shares or Recursion Class A common stock. Recursion expects no material change to its cash runway as a result of these acquisitions. Recursion expects both acquisitions to be completed in the second quarter of 2023, subject to applicable closing conditions.

- Cyclica: Cyclica has built an industry-leading digital chemistry software suite which enables mechanism of action deconvolution, generative chemistry, and molecular optimization tools. Recursion completed a prospective, blinded evaluation of their software against challenging internal programs, where we gained deep confidence in the power of their tools and reinforced our belief that this team could accelerate Recursion’s work across its pipeline and partnerships by rapidly advancing the discovery of new chemical entities. We believe that Cyclica’s tools will enhance the optimization of our compounds for efficacy while minimizing liabilities through generative machine learning approaches. The company is located in

- Internal Pipeline

- Cerebral Cavernous Malformation (CCM) (REC-994): Our Phase 2 SYCAMORE clinical trial is a double-blind, placebo-controlled safety, tolerability and exploratory efficacy study of this drug candidate in 60 participants with CCM. We have enrolled the majority of participants associated with this study, and most participants who have finished their first year of treatment have now enrolled in the long-term extension study. We expect to share top-line data in H2 2024.

- Neurofibromatosis Type 2 (NF2) (REC-2282): Our Phase 2/3 POPLAR clinical trial is a parallel group, two stage, randomized, multicenter study of this drug candidate in approximately 90 participants with progressive NF2-mutated meningiomas. Enrollment is ongoing and we expect to share a Phase 2 interim safety analysis in 2024.

- Familial Adenomatous Polyposis (FAP) (REC-4881): Our Phase 2 TUPELO clinical trial is a multicenter, randomized, double-blind, placebo-controlled two-part clinical trial to evaluate efficacy, safety, and pharmacokinetics of this drug candidate in patients with FAP. We continue to advance this study.

- AXIN1 or APC Mutant Cancers (REC-4881): REC-4881 is being studied for the potential treatment of AXIN1 or APC mutant cancers with an initial focus on solid tumors harboring these mutations. We are developing a Phase 2 open-label study for REC-4881 in participants with unresectable, locally advanced or metastatic cancer with AXIN1 or APC mutations. We expect to initiate a Phase 2 biomarker enriched study across select AXIN1 or APC mutant solid tumors in early 2024.

- Clostridioides difficile Colitis (REC-3964): Our Phase 1 clinical trial is a first-in-human protocol evaluating single and multiple doses of REC-3964 in healthy volunteers and will assess the safety, tolerability and pharmacokinetic profile of REC-3964. We have enrolled the majority of participants associated with this study, and REC-3964 has been well tolerated to date. We expect to share safety and PK data in H2 2023.

- RBM39 HR-Proficient Ovarian Cancer: In

January 2023 , we disclosed that RBM39 (previously identified as Target Gamma) is the novel CDK12-adjacent target identified by the Recursion OS. We believe that we can modulate this target to produce a potentially therapeutic effect in HR-proficient ovarian cancer. We have advanced this program to the preclinical stage and have initiated IND-enabling studies.

- Transformational Collaborations

- We continue to advance efforts to discover potential new therapeutics with our strategic partners in the areas of neuroscience and a single indication in gastrointestinal oncology (Roche-Genentech) as well as fibrotic disease (Bayer). In the near-term, there is the potential for option exercises associated with partnership programs, option exercises associated with map building initiatives or data sharing, and additional partnerships in large, intractable areas of biology or technological innovation.

- Recursion OS

- Industrialized Program Generation: This end-to-end process validates map-based insights without human intervention. Following the proposal of disease model starting points, Industrialized Program Generation carries out the programmatic selection of compound hits, compound ordering coordination, and validation through phenomic and transcriptomic profiling. Given the large number of proto-programs that are expected from this process, we look forward to leveraging the digital chemistry technology and expertise of the Cyclica and

Valence teams to design and optimize chemical structures for novel biological targets.

- Industrialized Program Generation: This end-to-end process validates map-based insights without human intervention. Following the proposal of disease model starting points, Industrialized Program Generation carries out the programmatic selection of compound hits, compound ordering coordination, and validation through phenomic and transcriptomic profiling. Given the large number of proto-programs that are expected from this process, we look forward to leveraging the digital chemistry technology and expertise of the Cyclica and

Additional Corporate Updates

- ESG Reporting: In

March 2023 , Recursion released its second annual ESG report. Materials from this report can be found at www.Recursion.com/esg. - Annual Shareholder Meeting: The Recursion Annual Shareholder Meeting will be held on

June 16, 2023 at12:00 pm Mountain Time . In preparation for this meeting, Recursion released its annual Proxy Statement inApril 2023 .

First Quarter 2023 Financial Results

- Cash Position: Cash and cash equivalents were

$473.1 million as ofMarch 31, 2023 . - Revenue: Total revenue was

$12.1 million for the first quarter of 2023, compared to$5.3 million for the first quarter of 2022. The increase was due to progress made in our Roche-Genentech collaboration. - Research and Development Expenses: Research and development expenses were

$46.7 million for the first quarter of 2023, compared to$32.4 million for the first quarter of 2022. The increase in research and development expenses was due to increased platform costs as we have expanded and upgraded our capabilities. - General and Administrative Expenses: General and administrative expenses were

$22.9 million for the first quarter of 2023, compared to$21.1 million for the first quarter of 2022. The increase in general and administrative expenses was due to an increase in salaries and wages of$1.2 million and increases in other administrative costs associated with growth in the size of the Company’s operations. - Net Loss: Net loss was

$65.3 million for the first quarter of 2023, compared to a net loss of$56.0 million for the first quarter of 2022.

About Recursion

Recursion is a clinical stage TechBio company leading the space by decoding biology to industrialize drug discovery. Enabling its mission is the Recursion OS, a platform built across diverse technologies that continuously expands one of the world’s largest proprietary biological and chemical datasets. Recursion leverages sophisticated machine-learning algorithms to distill from its dataset a collection of trillions of searchable relationships across biology and chemistry unconstrained by human bias. By commanding massive experimental scale — up to millions of wet lab experiments weekly — and massive computational scale — owning and operating one of the most powerful supercomputers in the world, Recursion is uniting technology, biology and chemistry to advance the future of medicine.

Recursion is headquartered in

Media Contact

Media@Recursion.com

Investor Contact

Investor@Recursion.com

Consolidated Statements of Operations

| Condensed Consolidated Statements of Operations (unaudited) | ||||||||

| (in thousands, except share and per share amounts) | ||||||||

| Three months ended |

||||||||

| Revenue | 2023 | 2022 | ||||||

| Operating revenue | $ | 12,134 | $ | 5,299 | ||||

| Grant revenue | — | 34 | ||||||

| Total revenue | 12,134 | 5,333 | ||||||

| Operating costs and expenses | ||||||||

| Cost of revenue | 12,448 | 7,799 | ||||||

| Research and development | 46,677 | 32,441 | ||||||

| General and administrative | 22,874 | 21,074 | ||||||

| Total operating costs and expenses | 81,999 | 61,314 | ||||||

| Loss from operations | (69,865 | ) | (55,981 | ) | ||||

| Other income, net | 4,538 | 2 | ||||||

| Net loss | $ | (65,327 | ) | $ | (55,979 | ) | ||

| Per share data | ||||||||

| Net loss per share of Class A and B common stock, basic and diluted | $ | (0.34 | ) | $ | (0.33 | ) | ||

| Weighted-average shares (Class A and B) outstanding, basic and diluted | 191,618,238 | 170,690,392 | ||||||

Consolidated Balance Sheets

| Condensed Consolidated Balance Sheets (unaudited) | ||||||||

| (in thousands) | ||||||||

| 2023 | 2022 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 473,145 | $ | 549,912 | ||||

| Restricted cash | 1,311 | 1,280 | ||||||

| Other receivables | 2,057 | 2,753 | ||||||

| Other current assets | 15,612 | 15,869 | ||||||

| Total current assets | 492,125 | 569,814 | ||||||

| Restricted cash, non-current | 7,920 | 7,920 | ||||||

| Property and equipment, net | 90,004 | 88,192 | ||||||

| Operating lease right-of-use assets | 35,116 | 33,255 | ||||||

| Intangible assets, net | 1,318 | 1,306 | ||||||

| 801 | 801 | |||||||

| Other assets, non-current | 82 | — | ||||||

| Total assets | $ | 627,366 | $ | 701,288 | ||||

| Liabilities and stockholders’ equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 4,247 | $ | 4,586 | ||||

| Accrued expenses and other liabilities | 25,041 | 32,904 | ||||||

| Unearned revenue | 57,761 | 56,726 | ||||||

| Notes payable | 661 | 97 | ||||||

| Operating lease liabilities | 4,440 | 5,952 | ||||||

| Total current liabilities | 92,150 | 100,265 | ||||||

| Unearned revenue, non-current | 57,091 | 70,261 | ||||||

| Notes payable, non-current | 1,179 | 536 | ||||||

| Operating lease liabilities, non-current | 46,771 | 44,420 | ||||||

| Total liabilities | 197,191 | 215,482 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Common stock (Class A and B) | 2 | 2 | ||||||

| Additional paid-in capital | 1,135,056 | 1,125,360 | ||||||

| Accumulated deficit | (704,883 | ) | (639,556 | ) | ||||

| Total stockholder's equity | 430,175 | 485,806 | ||||||

| Total liabilities and stockholders’ equity | $ | 627,366 | $ | 701,288 | ||||

Forward-Looking Statements

This document contains information that includes or is based upon "forward-looking statements" within the meaning of the Securities Litigation Reform Act of 1995, including, without limitation, those regarding the timing and completion of the Cyclica and

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c3df3bc8-8590-4790-b374-5e114fc452a1

Source: Recursion Pharmaceuticals